Nowcasting on near term AI/ML adoption Within financial institutions

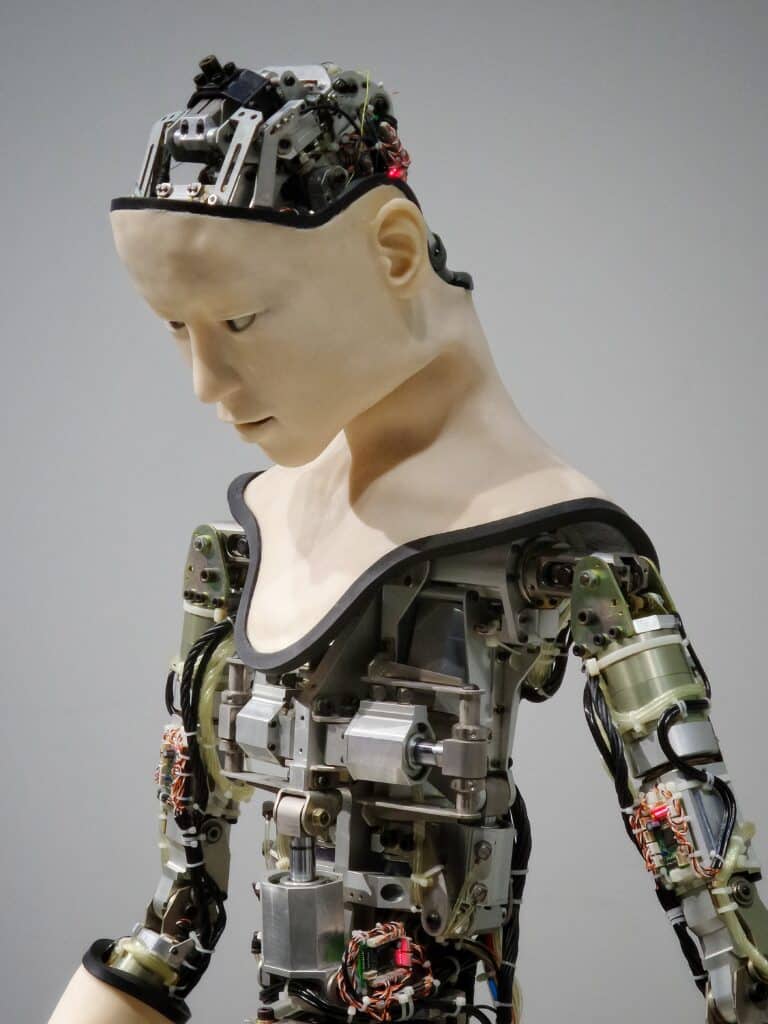

Artificial intelligence and machine learning (AI/ML) influence virtually every aspect of people’s daily lives -from the ability to unlock a mobile phone with facial ID, to online advertisements tailored to individual shopping habits, global positioning satellite programs that provide real-time alternate routes to road delays and banking security features that can rapidly detect fraud. Despite…