The Higher for Longer Part II Declared Jerome “The Hammer” Powell Issue

By Gary Brode, Deep Knowledge Investing

Fed Chairman, Jerome Powell, continues to hammer home his “higher for longer” mantra regarding rates. The pivot will come eventually, but no time soon. The economy is showing surprising strength, and while there is still some ambiguity to the data, the nightmare economic scenario is definitely not present yet. Employment and spending are still strong which will make it easier for the Fed to continue to raise rates. DKI thinks the Fed’s stance is less restrictive than others do so feel free to read multiple perspectives and let us know what you think. Are we right about the Fed, or have they over-tightened and need to lower now? Plus, we have some technically legal bank malfeasance and two bonus points this week…

1) Jerome Powell Goes to Europe and Reiterates “Higher for Longer”:

Federal Reserve Chairman, Jerome “The Hammer” Powell went to Portugal for a European Central Bank conference. While there, he emphasized the resilience of the US economy, and signaled again that he expected the Fed would raise rates twice more this year. He also reiterated his commitment to get inflation back down to 2%. The one surprise was Powell saying he didn’t expect to hit the target until 2025.

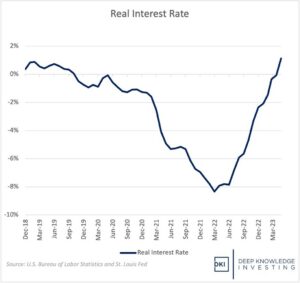

This doesn’t look restrictive to us.

DKI Takeaway: DKI has spent the last year saying the “pivot people” who expected the Fed to have already started reducing rates would be disappointed, and Powell is clear in his “higher for longer” mantra. We’re re-running the chart above to show that real rates (the fed funds rate less inflation) are just barely above 1%. The Fed still is not in restrictive territory yet. It just feels that way because the market has become accustomed to zero nominal rates and negative real rates.

2) GDP Revised Up?!:

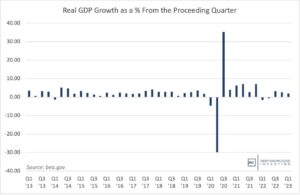

First quarter gross domestic product was revised up from 1.3% to 2.0%. The higher and positive growth for the economy will make it easier for the Fed to continue to raise rates. Fed Chair, Powell, has said the Fed will be “data driven” and an economy that refuses to fall into recession combined with low unemployment and high inflation means more rate hikes are on the way.

We acknowledge the big picture is better than we previously feared.

DKI Takeaway: This is a surprising revision. DKI has often commented on the tendency for government statistics to be very positive in their closely-followed initial reporting and then revised later to less positive levels when fewer people are watching. Seeing GDP revised upwards by .7% is unusual. We also note that all government statistics are faked in one way or another. If the government prints money and spends it paying people to do pointless “work”, that activity adds to GDP growth even if no value is created.