Is Jerome Powell Destroying the Economy?

By Gary Brode, Deep Knowledge Investing

Here’s a little Twitter fun from last week. Original piece is here:

Is Jerome Powell destroying the economy? For 2 years, DKI has been critical of the Fed for being too slow to raise rates. We also agree with FinTwit stars like @RudyHavenstein, @saifedean, @stackhodler, & @macrojack21 that we should #EndTheFed. But it’s not all Jerome’s fault:

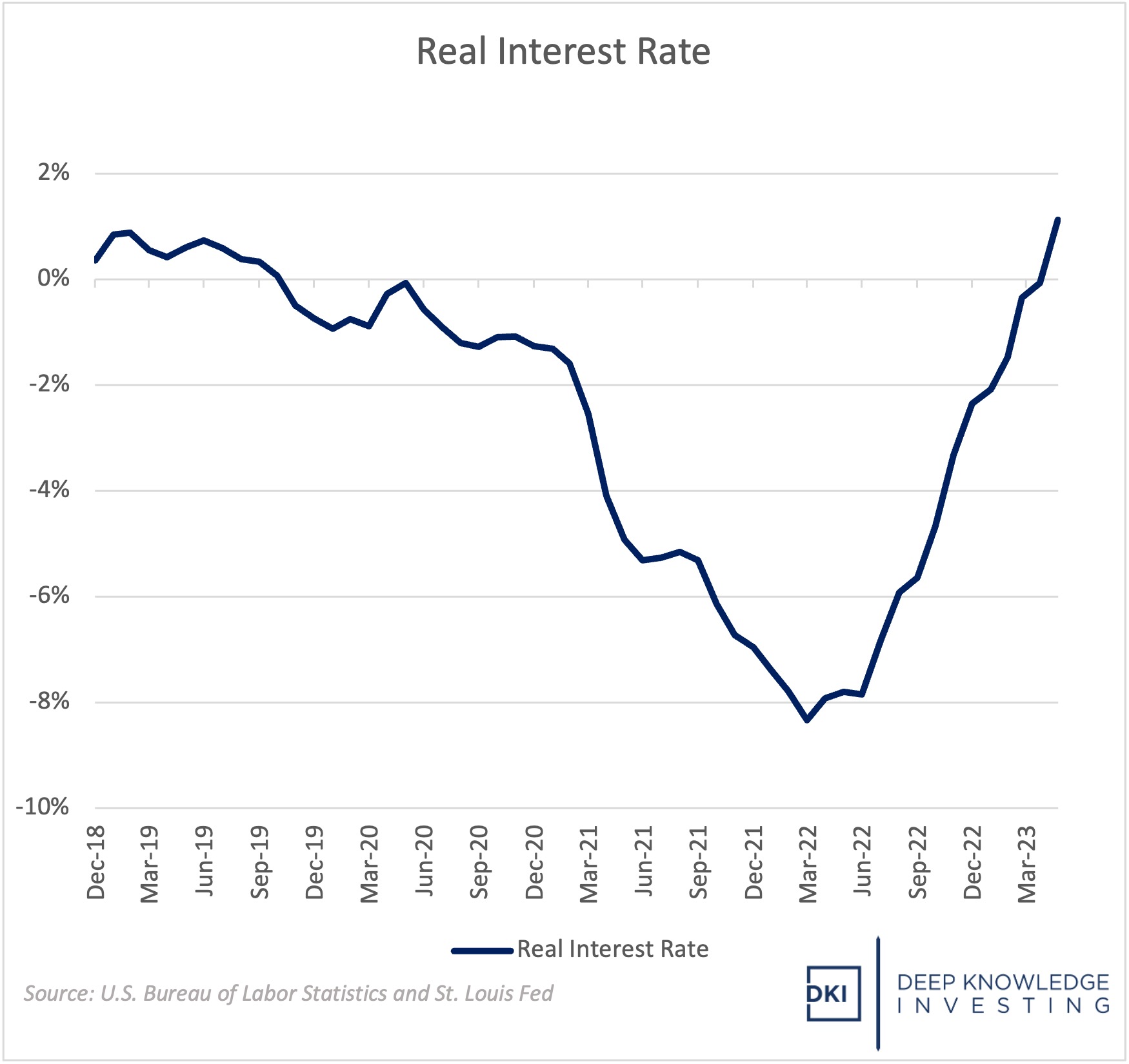

Asset gatherers masquerading as portfolio managers are claiming that draconian rate hikes are about to destroy the economy. We counter that over a decade of near-zero rates created the problem. Regarding those draconian hikes, real interest rates just “popped” barely above 0%.

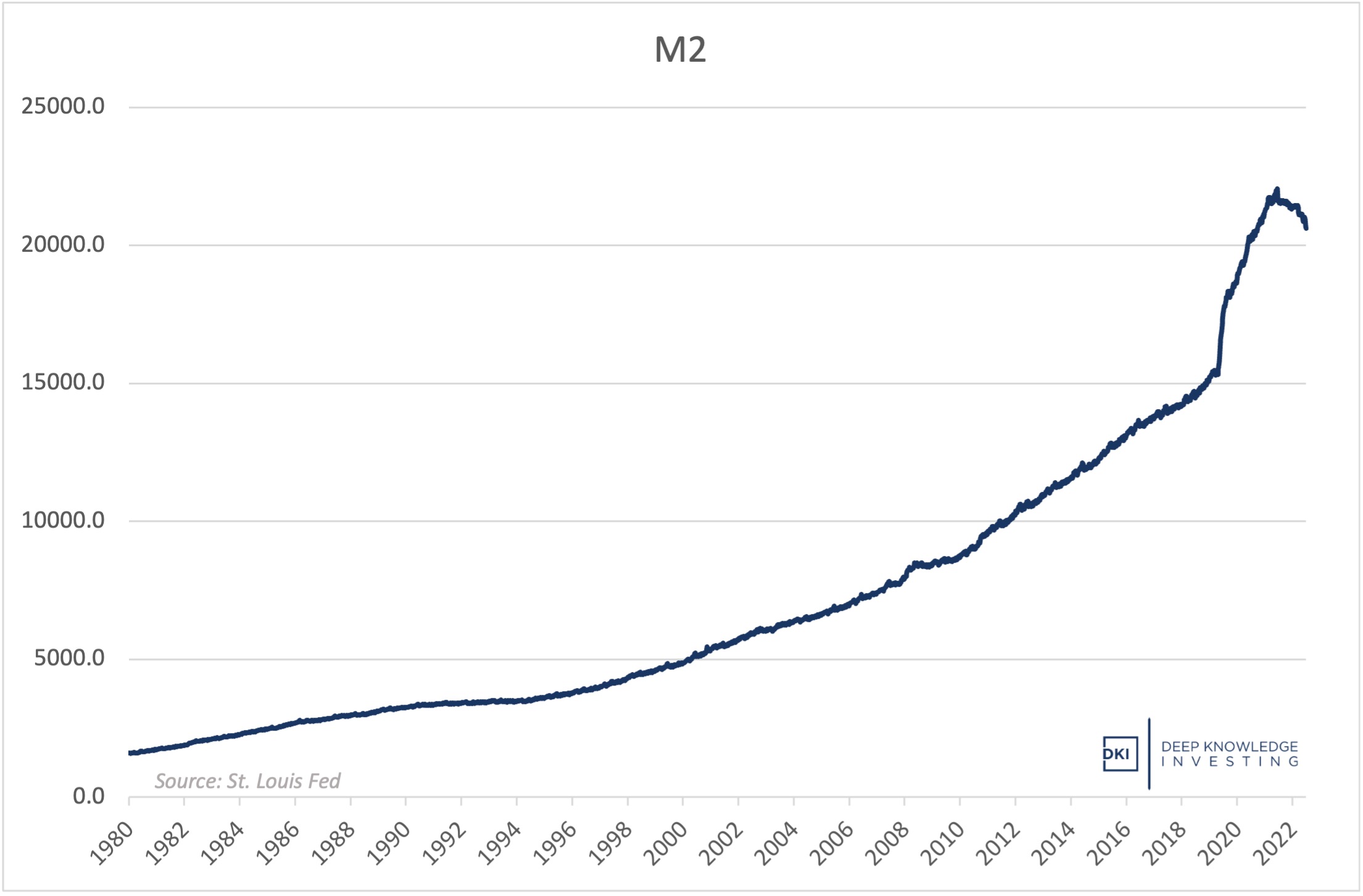

Others are saying that we’ve had a historic decline in the money supply which will lead to disaster. Technically, this langue is correct, but ignores magnitude. Yes, M2 is down, but look at the chart below to see this “historic” decline. Do you see the problem?

There was a comment in today’s WSJ about the Fed’s “aggressive balance sheet reduction”. Again, we concede that the Fed has reduced the size of its balance sheet, but off of a huge increase. The long-term chart below shows that where you pick your starting point matters.