The Cause of Inflation

By Gary Brode, Deep Knowlege Investing

DKI has written constantly about inflation since November of 2021 when we warned that it was going to be a bigger and more persistent problem than most people thought. We also provided practical specific ideas for how to protect your portfolio. By January of 2022, we were saying clearly that the Federal Reserve’s insistence that inflation was “transitory” was unsupported.

There’s an article on CNBC today that accurately explains the discrepancy. The relevant excerpt:

Officials initially dismissed inflation as transitory, expecting it to fall as pandemic-related factors dissipated, but were forced to play catch-up as price increases proved more durable.

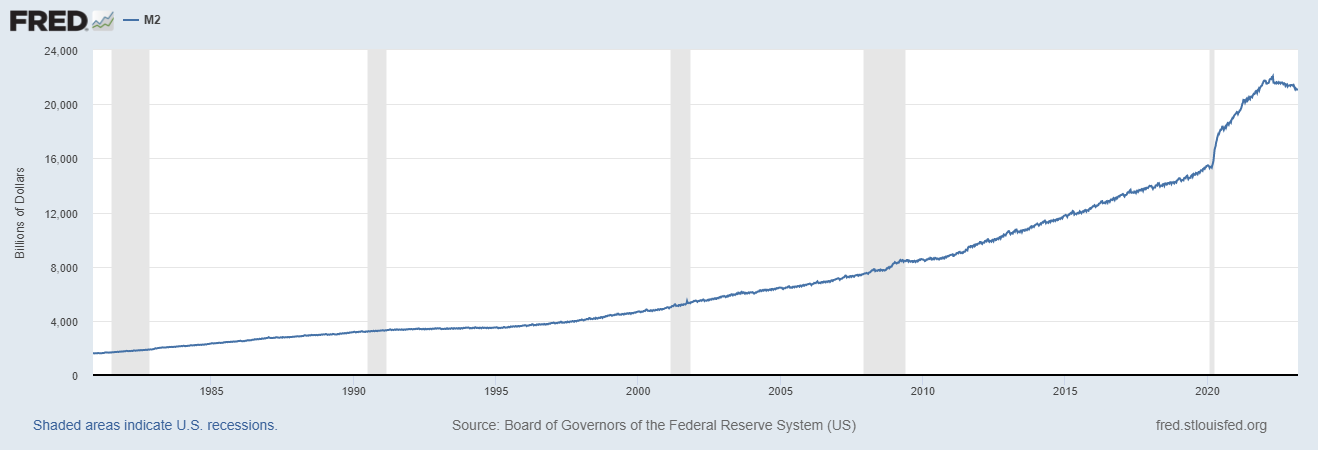

The Fed was incorrectly looking at temporary supply chain issues related to Covid as the cause of inflation. DKI was focused on the expansion of the money-supply. “Inflation” used to be defined as an increase in the supply of money. It’s easy to see in a chart from the St. Louis Fed:

It wasn’t Covid-related supply chain issues that caused inflation. It was Covid-related stimulus spending that kicked off the inflation mess we’ve experienced during the past two years.

Today’s announcement of the decline in the CPI to a still-high 5.0% has many convinced inflation is about to disappear. There’s no question that Federal Reserve rate hikes are bringing inflation down and that the accounting for housing prices have gone from understating the CPI to overstating it.

The issue that concerns us is the primary reason for the giant expansion of the money supply is government overspending. The US is still running a multi-trillion-dollar yearly deficit which is probably in the $5T – $8T range counting off-balance sheet spending (Medicare, social security, and other promises of future benefits). Neither party in Washington has shown an inclination to cut spending. That means that while the CPI will come down this year, it’s the decline in inflation that’s “transitory”. Long-term, the US (and most of the “developed” world) has two choices: cut spending, or face a future recurrence of inflation. What the Fed is doing right now is working. For there to be permanent change requires a different approach from Congress. We’re not going to get that.