The Next Decade of Alternative Investments, From Adolescence to Responsible Citizenship

Here are some of the highlights:

From Then to Now: A 15-Year Lookback

Highlights:

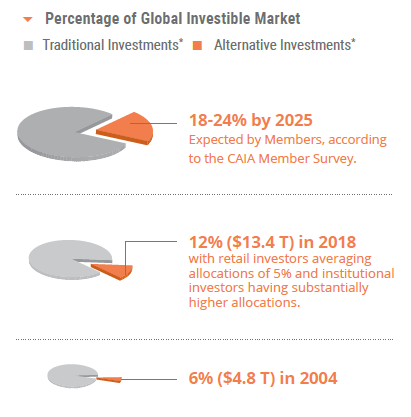

- How alternative investments doubled their global market share between 2003 and 2018

- Why record lows in global interest rates have driven pensions toward alternative investments

Highlights:

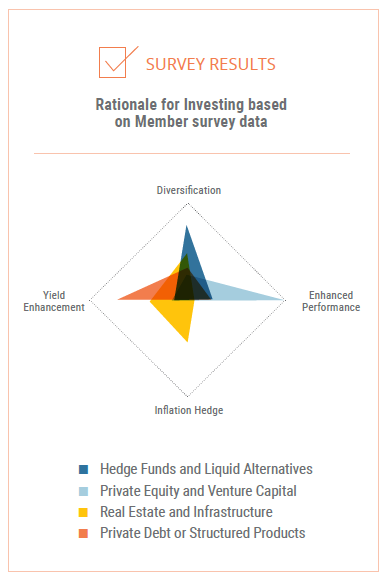

- CAIA Member rationales for investing in alternative asset classes

- How alternative assets classes can help responsible investors reap the long-term benefits of both risk mitigation and return enhancement

- Why value creation continues to shift from public markets to private markets